It has been over a year since the COVID-19 pandemic was declared by the World Health Organization and while it continues around the world, it's natural for more people to consider the relevance of life insurance in the current situation. In a

PwC survey

last year, 15% of respondents said they were likely to

buy life insurance

as a result of COVID-19.

While some life insurance companies have changed their approach to applications in response to the COVID-19 outbreak, Symmetry Financial Group’s independent agents will work with you for free remotely or in-person, with CDC-approved guidelines place, to tailor a policy to meet your needs.

Does life insurance cover COVID-19?

Yes. Even in the current climate, policies are being accepted at usual rates, and premiums aren’t expected to rise. The only exception is travelling to

high-risk areas

and not disclosing that on your application. Due to the current spread of the coronavirus, some insurers will postpone application approval if you have returned from traveling internationally within the last 30 days or have plans to travel abroad. Additionally, they may postpone your application if a member of your household has recently returned from travel outside the U.S.

What about a policy I already had in place before COVID-19?

In most cases, if you have an active policy in place, your family will still receive a death benefit if you pass away due to COVID-19. Life insurance generally covers pandemics so long as you were truthful in your application, you’re paying your premiums on time, and you secured coverage prior to an outbreak (your carrier may ask you about foreign travel or direct exposure to a virus when you apply for a policy).

Has COVID-19 made it harder to get a new life insurance policy?

If you've had the coronavirus or have recently traveled to a region with a heavy outbreak, applying for life insurance could take longer and end up being more expensive. Terms and rates may change as life insurance carriers continue adjusting to the situation.

To secure life insurance coverage, your best bet is to cancel international travel plans and to contact an agent who can shop for a policy on your behalf. Your agent can help you find a carrier that offers policies tailored to your specific needs so you can get coverage at an affordable rate in a timeframe that fits your schedule.

What steps have life insurance carriers taken in response to the coronavirus?

If your income has been affected because of a layoff or furlough due to the impact of the pandemic on your employer's business, it may be worth calling your Symmetry agent to see what options are available to you. Many carriers have programs in place to work with customers.

Life insurance premiums during a pandemic

Like any other medical diagnosis, the severity of an illness can impact your life insurance rates when you’re applying for a policy. If you were to contract the coronavirus and it caused long-term health problems before you applied for life insurance, you might end up receiving a lower health classification and a higher life insurance premium.

However, if you get ill, make a full recovery, and later apply for life insurance, you can expect a less severe price difference in life insurance premiums. And, as mentioned above, if your policy is already in force and you contract the coronavirus, there won't be any impact on your premiums.

Should I buy life insurance now?

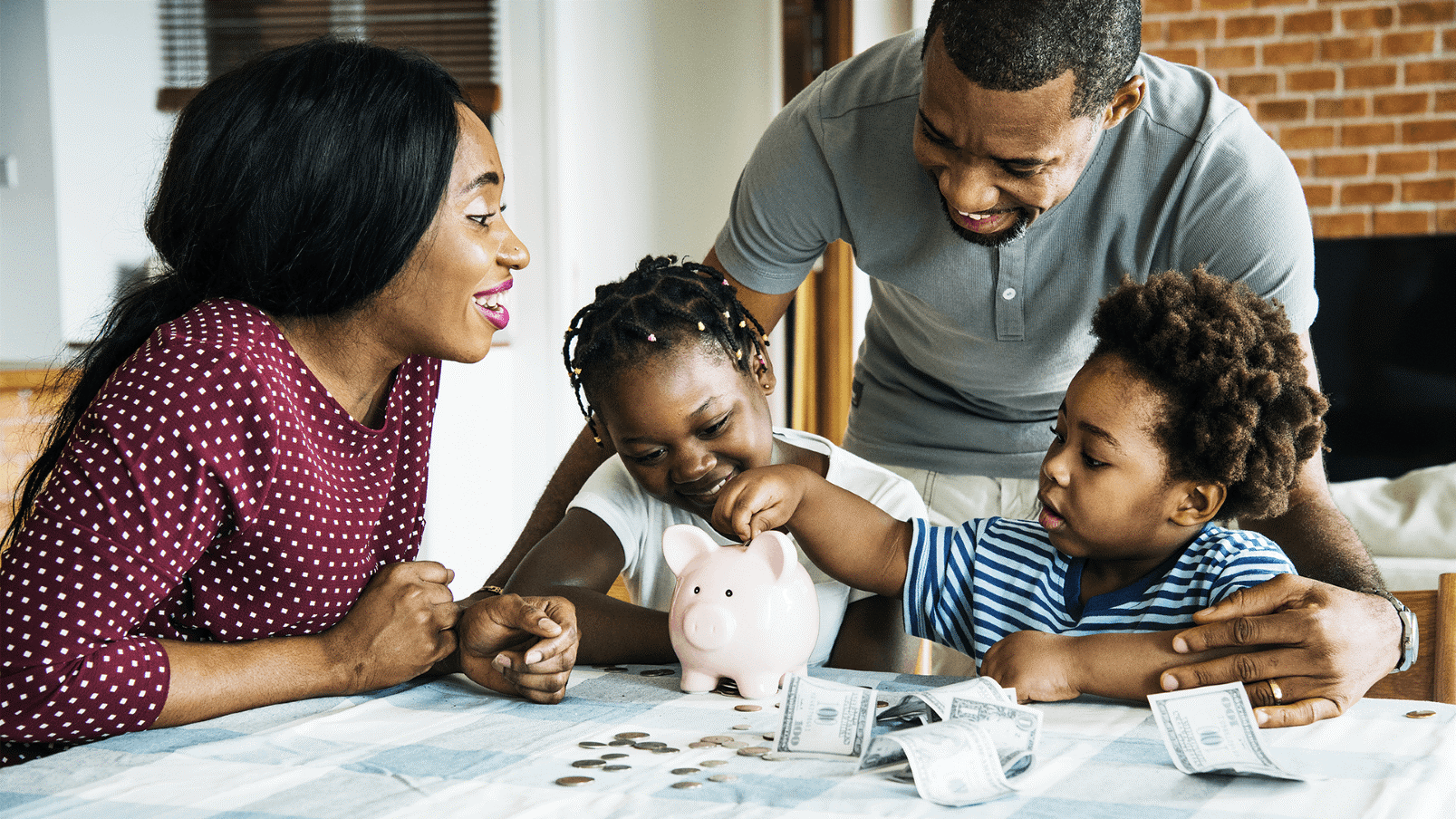

While a global health crisis shouldn’t be the driving force for obtaining life insurance, it can cause you to realize just how important it is to ensure your loved ones are financially protected if tragedy were to strike.

Life insurance works to protect those you love most with customized options for term lengths, death benefit amounts, and riders that protect against additional circumstances such as critical illness or disability. The best step you can take is to get in touch with a Symmetry agent who can assess your budget, lifestyle, and likelihood for securing coverage through different carriers.

With video conferencing available, you can meet with your agent without leaving your home

To make it even easier, your Symmetry agent offers video conference options to help you get a policy in place without having to leave your home. They can walk you through the entire process and help you get the best-fitting coverage for your needs and budget.

After one conversation, your agent will present you with several options to choose from, saving you the hassle of shopping around to compare rates. We partner with more than 30 of the highest rated insurance carriers in the nation to get you the best life insurance, mortgage protection insurance, retirement plans, annuities (and more) at the best price.

Request a quote today

and an agent in your area will be in touch to help you get the best-fitting policy for your needs in just a few simple steps!